Pay equality, gender parity, sexism and more. Amidst celebrating the achievements of women, there’s a lot of heavy stuff to consider on International Women’s Day. Something to add to the pile? Women and wealth management. As ladies climb the corporate ladder and become more successful, they are holding more wealth in Canada, which is amazing. The next logical thing to consider is how they’re planning to keep and grow the wealth they’re amassing. Statistics show that women face unique financial planning issues. They earn less on the dollar, have a longer life expectancy, must often take breaks in their careers to care for children or the elderly, and may not know how to begin investing. Most of these factors stem from inequality and social expectations that women around the world are trying to change but as it stands right now, there are a few things we can do to account for them.

1. Get help

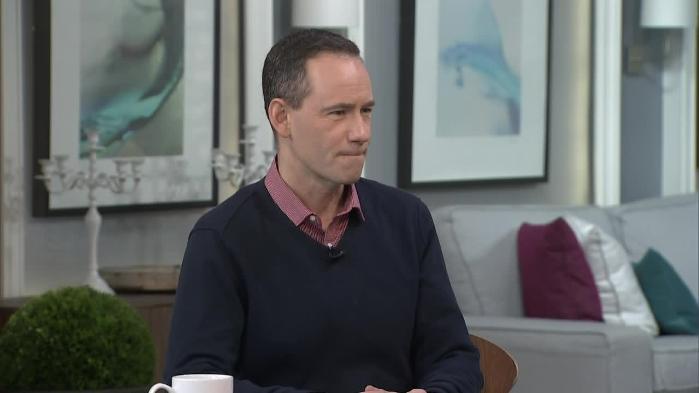

Seek out the assistance of an advisor with whom you can have open and honest communication, suggests Dan Nolan, a financial planner with Investment Planning Counsel. Life is hard, women are busy (typically more so than men due to having a chief caretaker role for children and taking on domestic duties) and a fee-for-service advisor will help you manage your money and give you the peace of mind you’re looking for so you don’t have yet another thing to stress out about. “It’s probably the best step they can take,” he says, “Everybody goes to a doctor when they’re sick, everybody goes to a mechanic when their car is broken. And our financial lives are just as important as any of those and many people don’t utilize expertise for their futures.” He suggests to interview a few planners you’re interested in before settling on someone you trust.

2. Create a plan

Once you have a financial planner, it’s time to create a plan. Make sure you have a clear objective and if you’re planning on having children or know that you may be caring for an elderly parent in the future, factor that into the plan when talking to your advisor. Once you know how much you need and when, the investment aspect of your financial plan will fall into place.

3. Factor in a longer life expectancy and later retirement

Studies indicate that while women have a longer life expectancy than men and therefore need to tuck away more retirement savings, they have fewer years to work to actually accumulate those savings (because of time off due to child and elder care needs). All things considered, a woman who started the same job as a man at the same time would have to save 18% of her income, versus her male counterpart, who would only need 10%. In Canada, men are expected to live to age 79 whereas women to age 83. Say, in this situation, you hoped to live on an annual retirement income of around $30,000. You’d have to save $120,000 more in total than a man—not exactly an easy feat if it wasn’t factored into your plan.

4. Don’t take the backseat

An issue facing older women now is that they might not have taken an active role during the financial planning process over the years. If they’ve outlived their partners, they’re suddenly left with a lot to learn quickly while possibly dealing with health issues and other life events. It happens much less frequently now, of course, says Nolan, but he reiterates that you should stay involved and not let your partner take over the financial planning discussions. Show up to meetings with the advisor and if you have concerns, make sure they’re heard.